USA Foreclosure & Market Health

The health of the real estate market nationwide took a hit recently as the number of completed foreclosures stayed above pre-crises averages. Though the number was actually down by 10% year over year, the total number of Foreclosures sat above 34,000 nationwide. That number is way above the monthly average prior to the real estate crash in 2008.

Completed foreclosures bounced around the 21,000 a month mark back in the 2000 – 2006 time frame. So that number really puts into perspective the 34,000 completed foreclosures over the last month. Though the nation is down at 71.3% compared to the nations peak number of completed foreclosures at 117,776 back in September of 2010. The nations real estate market health started to decline in September 2008 when 6.2 million families lost their home through the foreclosure process. When homeownership levels reached it’s peak in 2nd quarter of 2004, the total number of completed foreclosures sits around 8.2 million.

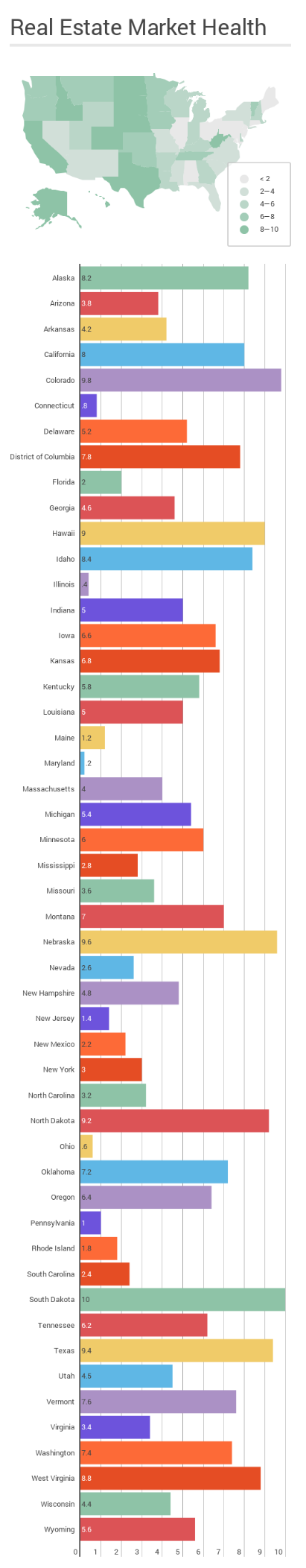

Though the total number of completed foreclosures stays above pre-crises levels, other distressed data was positive. The total foreclosure inventory only totaled about 434,000 houses or 1.1% of the mortgaged homes nationwide. That rate is actually down and sits at it’s lowest point since fall of 2007. But for an overview of the nations market health we provided a heatmap that ranks each state on Zillow’s 10 point scale based on past and projected evolution of home values, the prevalence of foreclosures, foreclosure re-sales, negative equity and delinquency, as well as whether homes are currently selling faster or slower than in the past.